Governance & Risk — Innovation Killers or Sound Strategy?

For many executives and leaders, extending transformation success beyond the tech space can present a challenge. That’s because successful transformation isn’t just about looking forward, it also requires that you understand a bit of history. If you’re trying to move forward, it’s imperative that you get your hand on My Years with General Motors, the autobiography written by GM’s first CEO, Alfred P. Sloan. It’s resonated deeply with our transformation work because it gives crystal clear insight into the fact that many of the problems we’re dealing with today were, in fact, solutions – once upon a time.

I picked this book up believing I’d get a little break from thinking about work, but instead I found myself nearly falling over in my seat as I read some passages. I felt a bit like at the end of the Usual Suspects, where the whole story plays back and the truth gets revealed, and you just sit there thinking: “oh, yeah, well, duh”. This book has a few of these moments, but the topic that stands out the most is risk – the lessons learned by corporations in their early days, how they relate to innovation, and how the effects continue to this day.

Vision – the accidental innovation killer

This story might sound familiar to anyone trying to make make decisions about introduction of innovation into a large organisation:

- A revolutionary engine design that would cost less to produce and maintain is envisioned by the resident visionary

- It’s “just about ready” and rushed into production

- The bits that are “just about ready” turn out to be an endless stream of problems that plague the reality of the real world and customers

- This creates an opening for entrenched interests to pounce on and shut down not just the innovation, but new ideas from this avenue.

Sloan describes the reaction to the failure:

“… [ our product strategy ] was valid if our [ product was ] at least equal in design to the best of our competitors in a grade, so that it was not necessary to lead in design or run the risk of untried experiments … [ we ] isolated [ our main business ] from the influence of advanced technology”

The effects on product development and corporate strategy are astounding. The take-away here wasn’t to improve the innovation process. Instead, GM is to treat innovation as a form of risk that’s better left to the market to absorb. Innovation, for GM, becomes subsumed by a broader survival strategy of appealing to lifestyle – a strategy which many product companies follow even today.

Risk Barriers - smart corporate strategies that don’t evolve

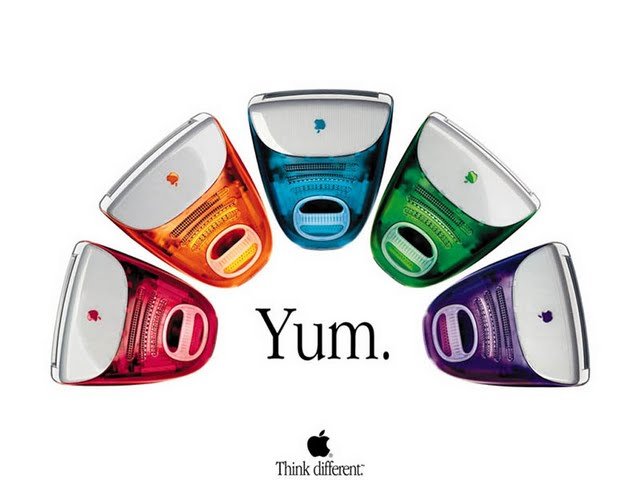

You can see this strategy in action in this GM ad from 1955 oozes lifestyle appeal, while touting run-of-the-mill tech:

It doesn’t look very different than this, does it?:  There’s nothing inherently wrong with risk-mitigation, these guys did great at the time. As with any good strategy, however, the problem is when it’s disconnected from its original purpose, and becomes less of an active response, and more like a single-purpose barrier unable to respond to shifting demands.

There’s nothing inherently wrong with risk-mitigation, these guys did great at the time. As with any good strategy, however, the problem is when it’s disconnected from its original purpose, and becomes less of an active response, and more like a single-purpose barrier unable to respond to shifting demands.

When your risk strategy is preventing the organisation from moving forward, you’ve got a Risk Barrier. Risk Barriers are directly patterned after these paleo-corporate strategies which many modern corporations still employ, regardless of whether the patterns continue to be useful.

This particular Risk Barrier was a solution that was meant to reduce the risk of catastrophic failure from innovation by averaging that risk across the market – riding the wave, if you will.

The problem with this “riding the wave” strategy is that when the wave starts to move too quickly, you’re left behind. In 2009 GM went bankrupt, and at the time, nobody was accusing it of being too innovative. It was saved from bankruptcy by a restructuring process that allowed it to shed all of the weight previously shielded by this very barrier.

How to overcome Risk Barriers

In order to successfully introduce new ways of working where these Risk Barriers are in place, you must be able to:

1. Show that the risk that is meant to be contained by the barrier is not relevant to your context.

In one example we saw, outdated governance practices were holding up projects. Quantifying that cost by looking closely at a single system, looking at the resources that were standing still and then extrapolating to all ongoing transformation work allowed for executive intervention

2. Create a consensus view around new or actual forms of risk created by market forces, technical innovations, and the combination thereof.

We worked with a team that was struggling to get specialised technology and training needs met because of the potential support costs and fear that the upskilling would encourage people to leave. We found concrete evidence for various scenarios where falling behind with industry practices could cut off a core revenue stream suddenly and without warning. This encouraged the organisation to think about how to evaluate needs that fell outside of its core support model.

3. Provide evidence as to how the new ways of working obviate the risk barrier.

In one effort, we discovered that providing customer service agents with a view into the same monitoring that the software developers had would allow them to drop many of their outdated documentation and information distribution practices. This got the organisation to see the value in cross-organisational efforts, and think more deeply about how their structure prevented useful innovations.

Modern working practices are only a means to an end. For those that work outside of technology, agile and lean ways of working provide little perceived benefit. By making the benefits of modern working practices directly relevant to broader strategic goals, especially through evidence, your transformation efforts will flourish.